Peercoin Staking – Everything You Need to Know

Peercoin (PPC) is the first blockchain project that implemented Proof-Of-Stake consensus which was considered as a bold move by many crypto enthusiasts. Of course, there was a high risk of failure because at that point POS was underrated and innovative to be publicly accepted without strong proof that it is reliable. Peercoin staking showed the audience that this was definitely a step forward, since the inflation rate dropped to 1% annual, without any max supply.

Pros & Cons

- The first coin which successfully implemented the Proof-of-Stake consensus

- The inflation rate is 1% on an annual basis

- The development team has been pro-active and on top of that, they have detailed documentation about everything, which usually is missing with other coins.

- You will need 30 days to start staking Peercoin, this so-called maturity period is considered to be too long

- Apart from that, the cooldown between the staking availability is also quite extended

- It uses one of the oldest core versions of BTC(V0.8), which was released back in 2013.

How to Stake Peercoin

With Peercoin is more important how long you hold the coins not how many you have. This pretty much was designed as an incentive for the investors to “hodl” their coins in a long term. In a manner of 30 days after each transaction, the coins are allowed to be minted. Part of the coins will be distributed to the minter for another 30 days, so he can use them to mint blocks. Another huge benefit is the incapability to perform an attack over the network because to do that the user must have a certain amount of coins and he must wait for the period of 30-60 days in order to do the attack, you can still do it, but it is not economically unviable. While with POW it’s not necessary to wait that long and to complete the assault. Those requirements are intentionally included in order to protect the investors from users which hold no coins and of course to increase the engagement of all users with the network and keep it stable and secure. Peercoin uses both POW and POS, POW algorithm is used to organize the distribution of new coins and POS to ensure the integrity of the network. Don’t forget that the longest POS coinage wins in case of blockchain split.

Minimum Requirements

- Windows 7 / Linux (Preferably Ubuntu 14 and up) / Mac OS X

- Installed Peercoin Core Wallet

- Minimum disk space of 900 MB

- 512 MB RAM

- No minimum or maximum internet speed

- You need to keep the wallet online 24/7

Summary: To obtain PPC coins you will need exchange services, I will recommend you trust only those which are widely known and reliable, for example, Bittrex. Afterward you need to transfer them from the exchange to your staking wallet and hold them for 30 days in order to start the minting process, in about 90 days the coinage will be maxed. Which means that the only variable left in POS is the current difficulty. Minting predictions could be calculated for given transactions with the estimation of the POS network difficulty over time, so your transaction will be able to mint POS blocks. Whenever POS difficulty is higher than the networks difficulty you will be allowed to mind a POS block.

Peercoin Wallet Setup (GUI)

Step 1: Download & Install the Official Wallet

You can download the official wallet from their webpage (https://peercoin.net/download). The first time when you run it, it will ask you for a destination folder to store the whole blockchain on your hard-drive.

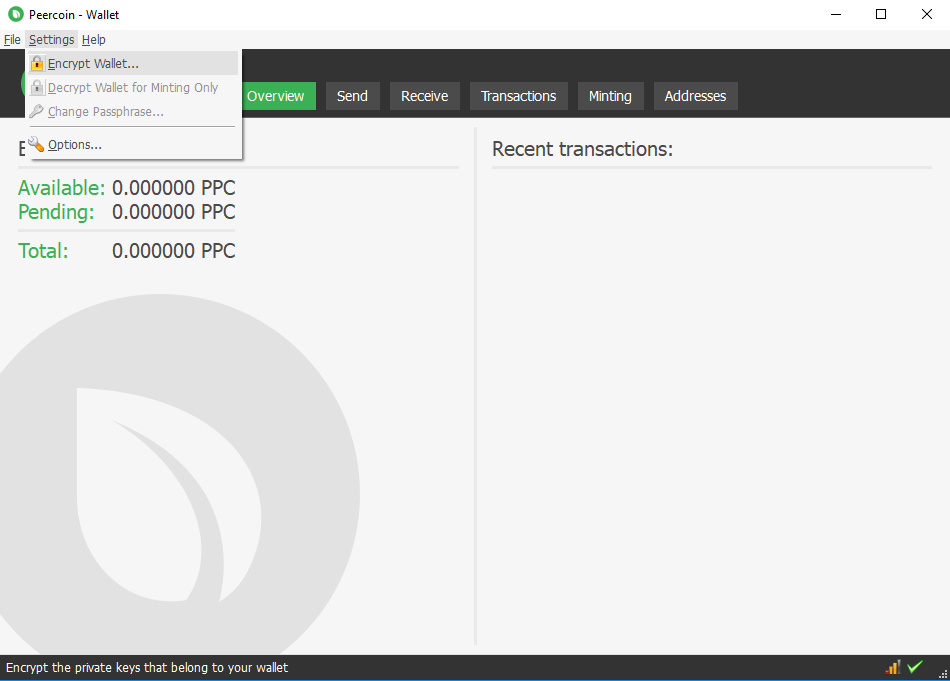

Step 2: Encrypt The Peercoin Wallet

Encryption of your wallet is recommended, and it is easy to achieve, just enter the settings menu and go the “Encrypt wallet” section, enter your password and restart the wallet, that’s all.

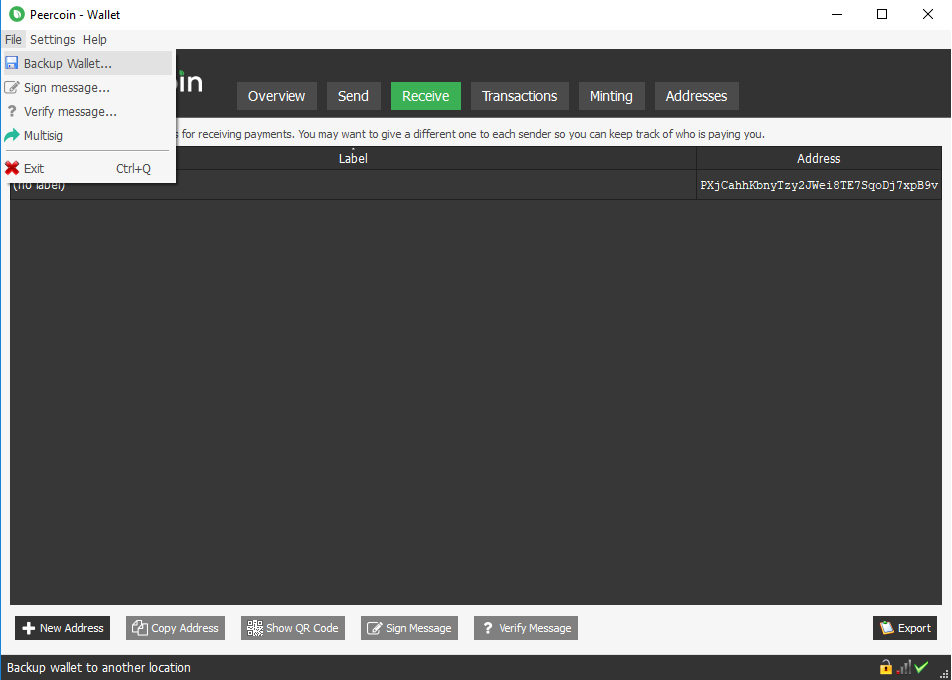

Step 3: Backup The Peercoin Wallet

Back-up of your wallet is what follows. It is super easy, just go on the “file” section and chooses the options “Backup wallet”, enter a name and save it. My personal recommendation is to keep those files on a flash-drive or separate hardware device without any internet access, exposure to the web may cost you security breach and lost funds.

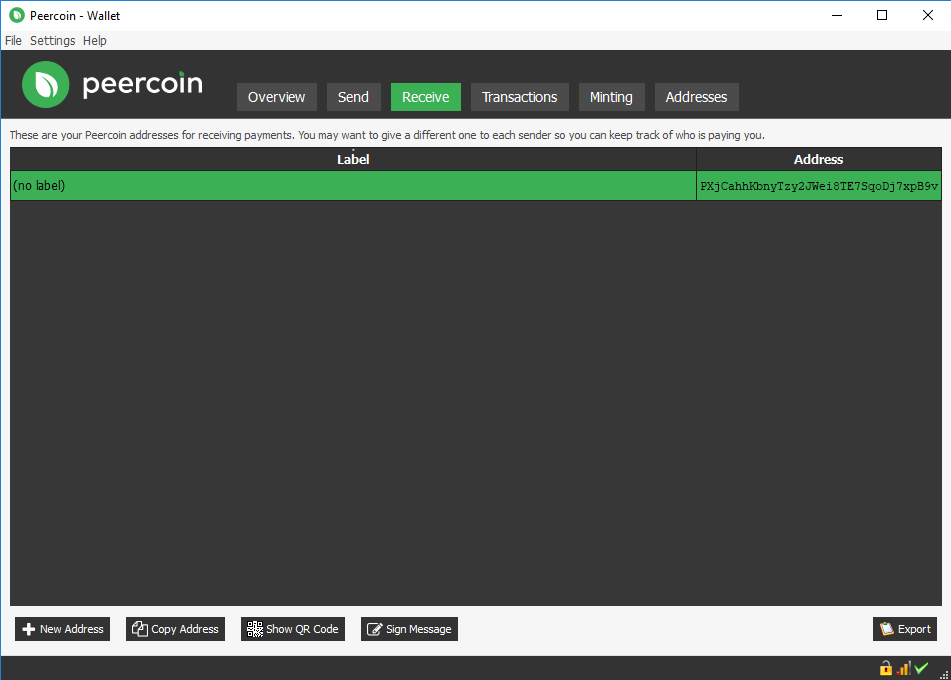

Step 4: Create a Wallet Address

To create a new address, you need to click on the “receive” tab, seek for “+ sign” at the bottom of the page, when you find it, choose “new address” and label it. Select the address and copy it.

Step 5: Transfer Coins to the Wallet

With the address copied, go back to your exchange and send 1 PPC to that address. After you see the pop up showing you that the transactions are valid, you can send the rest of your coins to that address.

Step 6: Unlock the Peercoin Wallet

After you receive 6 confirmation on all digital assets of yours, you should unlock your wallet. Go to the settings menu and decrypt the wallet for minting only. At that point, you must wait for 520 blocks until those coins are maturing. When the period of 30 days is over you will be able to start staking Peercoin funds.

Staking with the Command Line Wallet (CLI)

This method is oriented to the people with not that powerful machines, wanting to spend the least amount of resources. Ever since we don’t use QT-wallet, the process is all about command lines. If you are not that technically backed-up, I will suggest your method 1. I know that most of you have the intention to use Linux based OS, so here is the guide on Ubuntu.

Step 1: Download & Installing

Let’s download the wallet. Type in the following:

sudo apt-get install unzip

sudo apt-get install curl

curl –s https://api.github.com/repos/peercoin/peercoin/releases/latest | grep browser_download_url | cut –d ‘”’ -f 4

These commands will show you the latest version of the official wallets. Since we are doing this example in Ubuntu, we will download the one names Linux.zip.

Before you extract the files create a folder for that purpose. Type in:

mkdir peercoin

This code will create a folder in your home folder. If you have another directory in mind you can just easily change the path. Now, copy the link from above and use it in the next command.

wget / paste the link which has Linux in its name and ends on .zip

Example:

wget https://github.com/peercoin/peercoin/releases/download/v0.6.4ppc/peercoin-v0.6.4ppc-Linux-gitian.zip

After you’re done, unzip it and then remove the junk file

unzip peercoin-v0.6.4ppc-Linux-gitian.zip ~/peercoin

cd bulwark/

This command will unpack the files. Change the numbers if you have a newer version.

rm -rf unzip peercoin-v0.6.4ppc-Linux-gitian.zip

By this command, you can relocate the files in a new location and remove the file which we unzipped. Be careful which Peercoin folder you remove. The one that ends with .zip needs to be removed.

cd peercoin/bin/

Now you need to pick your bit versions, especially if your machine has less then 4GB RAM, you can use the 32 bits, otherwise 64 bits.

cd ~/bulwark/

If you have less than 4 GB of ram type in:

cd 32/

If you have 4 GB of ram or more type in:

cd 64/

Launch the wallet for the first time and type in:

./peercoind -daemon

Initially, the wallet will close itself and ask you to type in a rpcuser and rpcpassword. Afterward, type in the following command:

cd ~/.peercoin && nano peercoin.conf

This command will create a text file and open it. Type in:

rpcuser= Username

rpcpassword= Password

After you’re done with replacing the

cd ~/peercoin/bin/

./peercoind -daemon

Step 2: Encrypt the CLI Wallet

Use this command to encrypt your wallet. Replace

./peercoind encryptwallet / your password

Do not forget the passphrase. No one can help you if you forget it.

After you’ve typed in the command above with your passphrase, the wallet will shut down. Type the following and launch the client:

./peercoind -daemon

Step 3: Backup the CLI Wallet

This step is extremely important and should not be skipped. To back up your wallet type in:

./peercoind backupwallet Example: ./peercoind backupwallet ~/peercoin/bin/

Step 4: Transfer Coins to the Wallet

Create a new address in your wallet to which you will send the coins for staking. Type in:

./peercoind getnewaddress

Now you should go to the exchange where you obtained your coins and send exactly 1 PPC to that address. After you confirm that the coins are on their way you can send the rest of them.

Don’t forget that you need 67 confirmations to be able to stake.

Step 5: Unlock the CLI Wallet

Before we can start staking, we need to unlock the wallet. Use this command:

./peercoind walletpassphrase - passphrase 9999999 true

<passphrase> – the passphrase you used to encrypt your wallet.

999999999 – the number of seconds which your wallet will stay unlocked, zero means unlimited

true – unlocked only for staking.

And that’s it. You should be ready for staking.

And finally, let’s check the status of your staking. Type in:

./peercoind listminting

This command will give you a rough overview of what’s going on with your staking process.

Peercoin Staking Reward

With Peercoin it really doesn’t matter what you do, your ROI over your staked amount will always be 1%. That’s because the algorithm is mainly based on the coins age. When you solve a block, a new transaction will appear under the name “mint by the stake”. From then on, the next 520 confirmations (around 3-4 days) your coins are used to mind the block and they are locked under the “stake” balance. No need to worry, they will be released for spending after those 520 confirmations. This appears to be another measure to optimize the minting process and assure the security of the network.

How to Maximize Rewards

There is no specific tactic to increase the income from Peercoin staking, even if you split your addresses or gather several outputs in 1 input. The reward is distributed based on the coinage not on the number of coins, so that trick is not applicable in that network. The only way that I can suggest, is to minimize the recourses for that purpose you need to invest in Raspberry PI.

-

Pool Staking

- First of all, there’s no official one pointed by the development team, so it will be best to stay away from the pools. On top of that, there’s is no sense to do it since the reward is static 1% ROI annual.

-

Coin Control

- The missing RPC commands from the old wallets is the main reason why we don’t really know what exactly is going on, but indeed there is a way to go around that. The “minting” tab in the wallet was implemented to stow the status of the coins. If there is a red color that means that the transactions haven’t reached its 30 days maturity to start staking Peercoin. Right after that time frame is over, the color will change to green and after 90 days it will change to dark green. Respectively at that moment, you will be next in line to get a reward because the change to get it will be increased to 99.9%.

Figure out Your Profit with the Peercoin Staking Calculator

Using the calculator below, you can estimate your profits from staking Peercoin. From the number received, you’ll need to deduct electricity expenses for the machine running your wallet, so you can calculate your estimated net earnings.

FAQ

Yes, it is minable but not profitable at all.

Yes, you can but you will need to use the command line wallet mentioned in the article.

It takes 6 confirmations for your coins to reach your wallet and get confirmed which in a timely manner is around 3-4 days. Right after, 520 blocks more before the coin starts counting and 30 days later you will be able to start staking PPC.

The answer to that question depends on your criteria. It is the first POS network and having that in mind, is one of the best possible option supporting that type of consensus. There is no right answer to that, it depends on the individual perspectives.

No, there is no max supply, but the inflation rate is 1% per year.

Staking is better because there is no need to invest in expensive hardware and you can just wait and earn.

There are 2 options, you didn’t unlock your wallet for minting, or you didn’t wait long enough for your coins to become mature.

About Peercoin (PPC)

Peercoin is one of the first hybrid coins, based on a combination of Proof of Work and Proof of Stake consensus algorithms. It was released to the public in August 2012 with Scott Nadal and Sunny King pointed out as its creators. The source code is partially based on that of Bitcoin, however, there have been major improvements introduced. Coins are issued through mining and minting, using the SHA-256 algorithm. In time, PoW is going to be phased out in favor of the more energy-efficient PoS consensus. Stakers are rewarded based on the amount of coins they own, but all in all, the yearly interest they receive is target at 1%.

Unique Selling Points

Remarkably, Peercoin was the first blockchain which explored the usefulness of Proof of Stake consensus. It has the lowest inflation possible and consistent ROI (return of investment) rate.

Team

The team behind the project prefers to stay anonymous and you cannot find any information about them online.

Network

The network uses light and full nodes to support the internal processed but unfortunately, there are no Masternodes and there never will be.

Privacy

Because the code base is borrowed from a very old version of Bitcoin core, there are no privacy functions implemented on the network itself.

Future

Update of the core version is planned altogether with cold staking mechanism, at least that is the plan till the end of next year. Also, in the period 2019-2020 implementation of payment channels is expected to enable the connection with lightning nodes and perform an instant transaction on a second layer. The last improvement mentioned is the dynamic block size mechanism, but there is no certain date or so, it is just a discussion at this point.

Useful Weblinks

- Official Website: https://peercoin.net

- Announcement Page: https://bitcointalk.org/index.php?topic=101820.0

- GitHub: https://github.com/peercoin

- Block Explorer: https://chainz.cryptoid.info/ppc

- Whitepaper: https://peercoin.net/whitepapers/peercoin-paper.pdf

- Socials:

- Twitter Discord Telegram Reddit Facebook